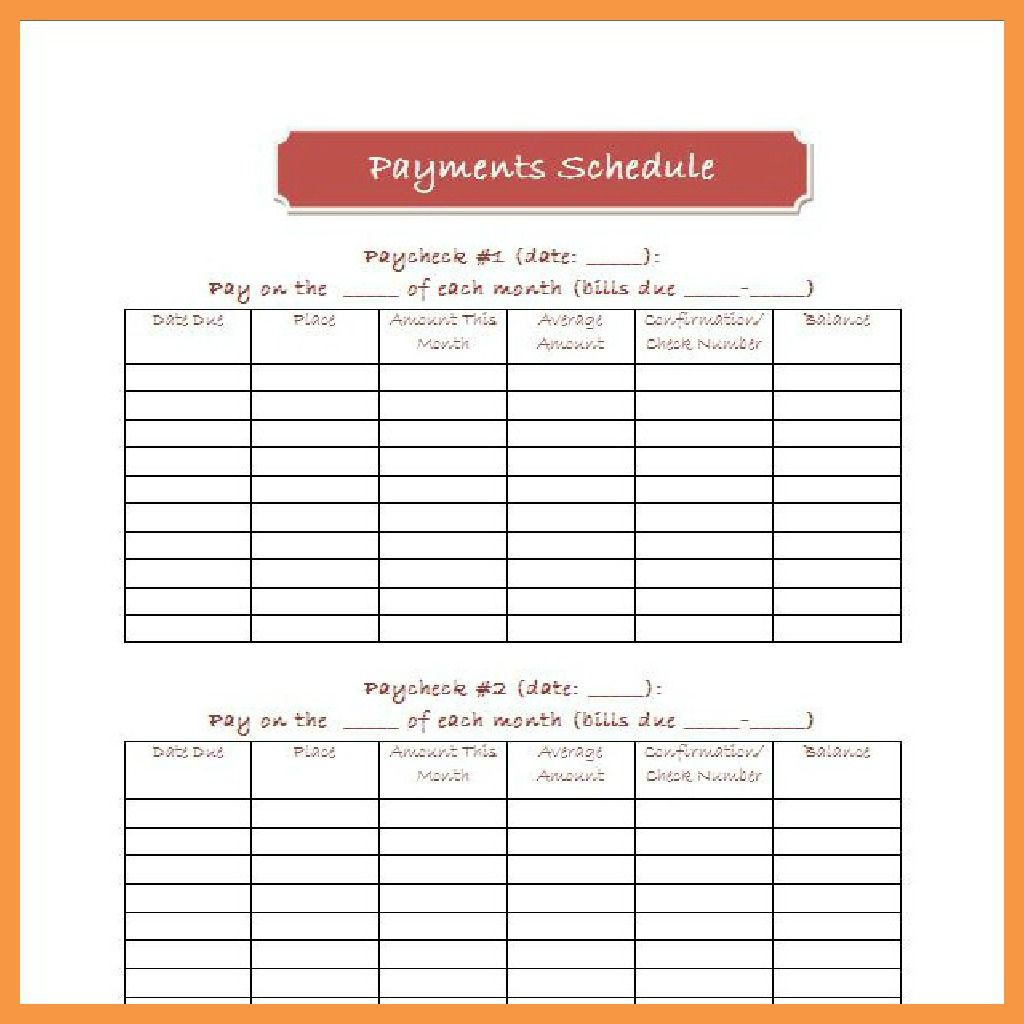

This type of calendar helps you organize your bills based on when they are paid. Once you’ve listed out all your bills, it’s time to add them to your Bill Payment Calendar. So, the more prepared you are with your budget, the more likely it is to work! Biweekly Budget Step 2: Create your bill payment calendar. Although no system will be perfect, this is when so many people give up on their budget plan. If you forget to add a monthly expense to your list, your entire biweekly budget can be thrown off. Go through every transaction and highlight the bills that come out every month. To ensure you don’t miss any bills, print out your last two months’ bank statements. Grab a piece of paper and list out all your bills, the amount due, and their due dates. However, no matter if you are paid biweekly or twice a month, the following steps will help you write a budget that you can stick to! Biweekly Budget Step 1: List out your bills. They won’t have the opportunity to enjoy those third paycheck months. Those who are paid twice each month will only receive 24 paychecks. Is biweekly pay the same as getting paid twice a month?īiweekly pay isn’t the same as getting paid twice each month. Wondering what you should do with this third paycheck? Don’t worry! We will cover that in this article. Most months, you will receive two paychecks, but two months out of the year, you will receive three paychecks. If you are paid biweekly, you will receive 26 paychecks throughout the course of the year. A post shared by Allison Baggerly What is biweekly pay?

0 kommentar(er)

0 kommentar(er)